A new alert regarding an alarming surge in phony text messages supposedly from the electronic toll collection service FasTrak, are being sent to American motorists. Scammers target program users with the phony messages that allegedly will threaten to shut down their account unless they provide personal financial and identifying information that could be used to steal their identity.

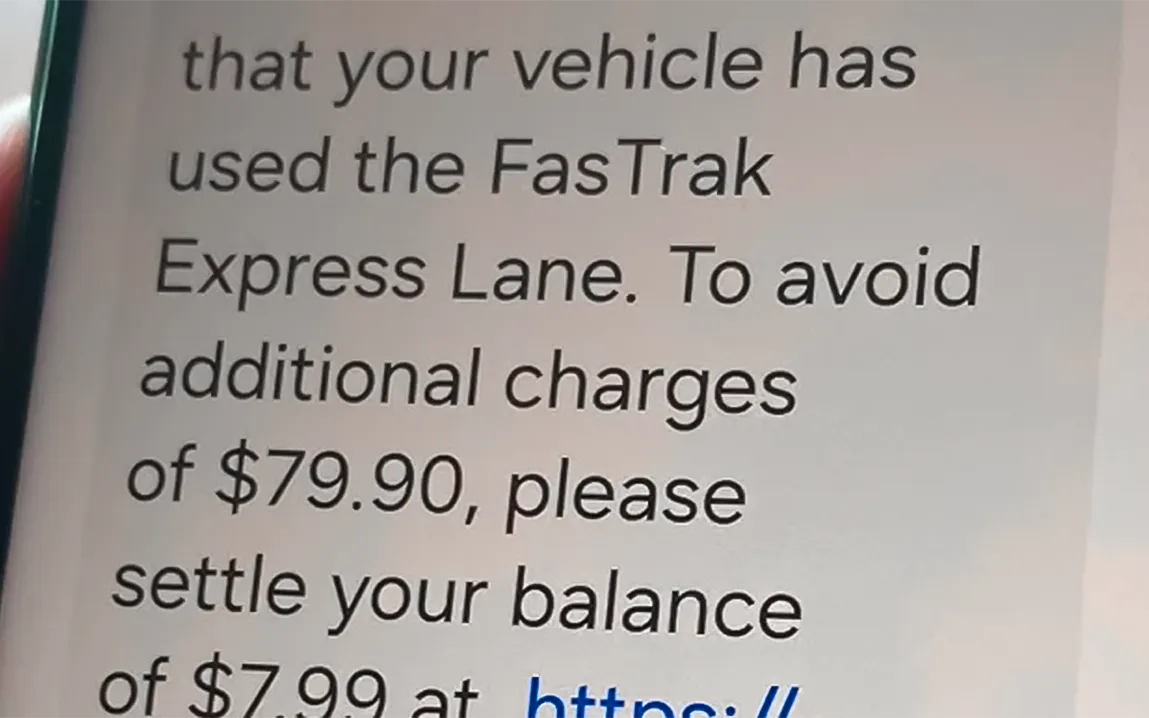

The scam typically starts with a text message that reads, “A toll is urgently needed to be paid.” Clicking on the link provided in the message opens a website that looks similar to the official FasTrak page. Victims might unwittingly give criminals access to their credit card information, bank account information, or other private information when they click on the link.

The authorities argue that these spoof emails are one in a tide of phishing efforts aimed at toll payers. The California Department of Transportation-Caltrans, the department responsible for FasTrak administration, reported that the agency never sends uninvited SMS requests for cash.

How to Detect Fake FasTrak Messages

To aid users in identifying the scam, FasTrak has come up with guidelines:

Check the Sender: Legitimate messages from FasTrak will come from official channels, not random or unfamiliar phone numbers.

Do Not Click Suspicious Links: Be wary of links in unsolicited messages. Instead, visit the FasTrak website directly through your browser.

Verify Payment Requests: FasTrak usually sends official notifications via email or mail, not through text messages.

Report Suspicious Messages: If you have received a suspicious text, immediately report it to FasTrak through their customer service hotline or website.

What to Do If You’ve Been Targeted

If you believe you may have interacted with a phishing text, there are steps to take right away:

Change all your account passwords immediately.

Look out for any suspicious transactions in your bank account.

Flag the account for possible fraud by getting in touch with your financial institution.

Inform your local police enforcement and the Federal Trade Commission of the incident.

Due to increased phishing schemes, you have to be careful in dealing with digital communications. You can avoid falling for them by being very cautious and ascertaining that messages are authentic.

To help put an end to the spread of this fraudulent activity, be vigilant and alert your friends and relatives.