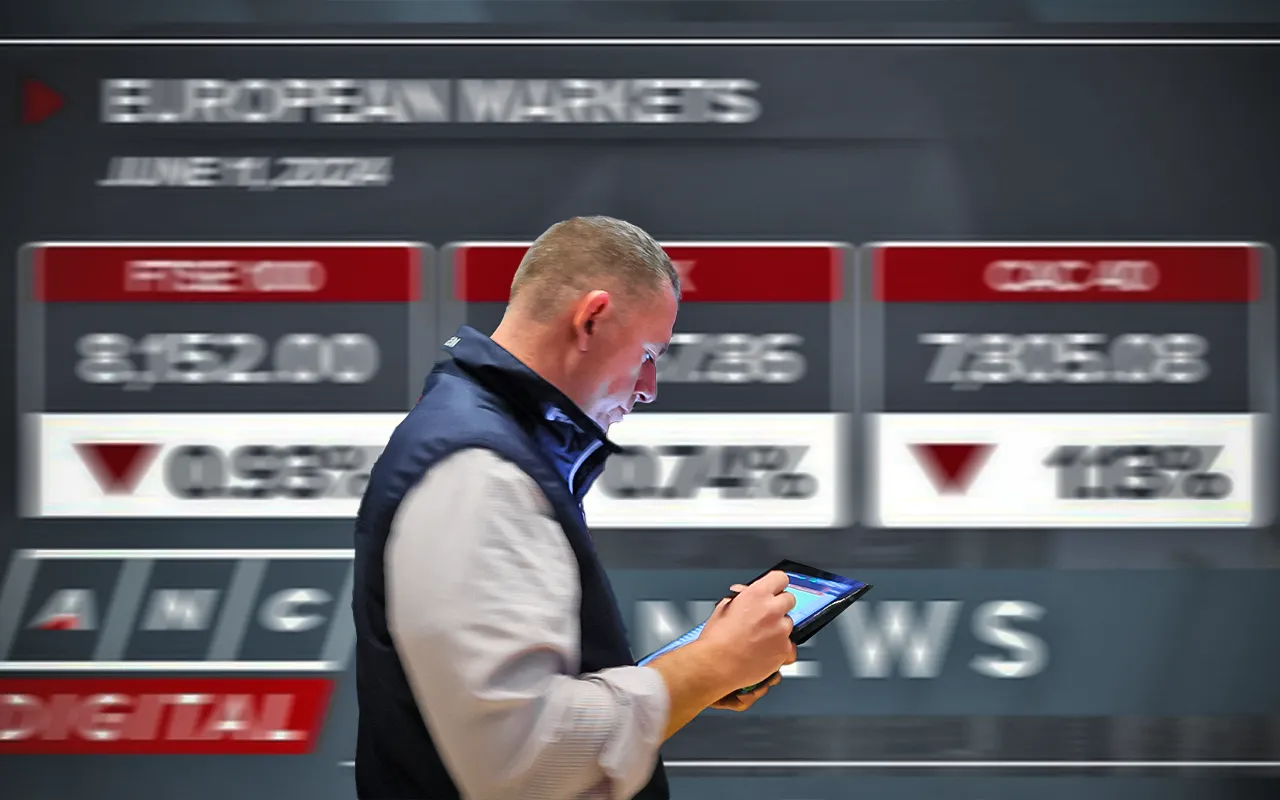

London- Many analysts predicted mixed emotions as the European markets began on Wednesday with the latest U.S. inflation data to be released later in the day.

European markets are pointed toward a divided opening as traders look forward to key U.S. inflation data that might further dictate the future monetary policy path. Cautiously optimistic perhaps best describes market sentiment in the wake of recent economic indicators and geopolitical events. As markets prepare for this latest release of data, seesawing performance by Chinese manufacturing output and mixed signals from the U.S. economy have investors on tenterhooks—a fact reflected in cautious anticipation evident across the globe.

The same period has much attention being given to heavyweight technology stocks such as Apple and Nvidia, whose stocks have fared well on the back of improvements in AI, among other technological advancements. Investors especially are attuned to how such companies will respond to economic indications, including the potential change in U.S. Federal Reserve policies after the report on inflation.

European markets also continue to digest a raft of data points across manufacturing to service sector activity that may temporarily influence trade action. For instance, ahead of key economic announcements, there’s always some sort of suspense over how the interest rates-that directly influence the dynamics of international investments-will be maneuvered by central banks, notably the ECB and the Fed.

This backdrop provides the playing field for a potentially highly volatile day, as markets will react to not only U.S. CPI data but also broader indicators of the global economic system. Investors are advised to pay close attention, as these could bear heavy implications on both short-term trading and long-term investment planning.