A federal judge extended her order blocking the Biden administration’s student loan forgiveness program,

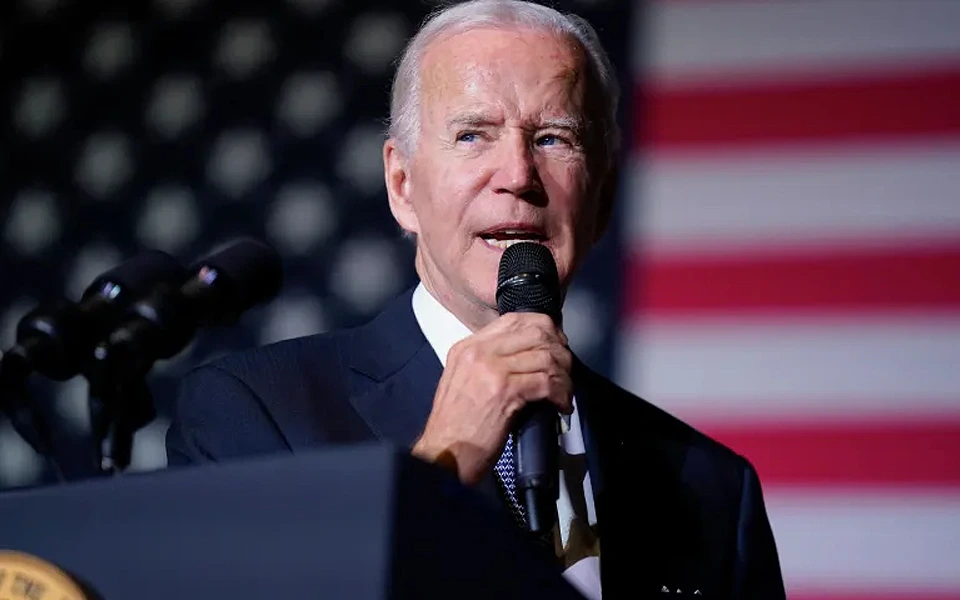

That’s the latest hiccup in President Joe Biden’s initiative, which has faced one legal challenge after another since he first announced it.

A U.S. District Judge Amy Coney Barrett on Thursday extended her earlier injunction that puts the program on hold as the court examines lawsuits brought by several states and conservative groups opposing Biden’s proposal to cancel up to $20,000 in federal student loan debt for qualifying borrowers.

These groups argued that Biden’s decision overshadows the administration’s executive authority and unfairly shifts the burden of the loans onto taxpayers.

Impact on Borrowers

The Biden administration, while defending the student loan forgiveness plan, clarified that it is a justified response to the economic hardships suffered by millions of Americans, particularly with the pandemic ravage of COVID-19. While defending its ground, the White House cited grounds that stated that it was within its lawful authority under the 2003 HEROES Act to modify the student loan programs during a national emergency.

However, with Judge Barrett’s ruling, it is clear that the legal battles haven’t ended. “The plaintiffs raise substantial questions regarding the lawfulness of the student loan forgiveness plan, so further review is warranted before any final order,” she said in her order.

The lawsuits mainly predicate their argument on the fact that Biden’s executive action sidelines Congress, which constitutionally holds the power to make massive overhauls of federal spending programs, like student loan forgiveness. Missouri, Nebraska, and Arkansas had filed in court claims arguing that the plan would harm state-run loan servicers who would be deprived of revenue.

Impact on Borrowers

The program was going to start early this year, and it would reach nearly 40 million Americans. On the original proposal, borrowers who earn less than $125,000 a year are qualified for loan forgiveness up to $10,000 and Pell Grant recipients get up to $20,000.

More frustration for many of the borrowers in this extended block: “We were counting on this relief to ease some of the financial pressure,” said Erica James, a recent college graduate. “Now, everything is in limbo, and we do not know how long it will take.”

So far, the Biden administration has been trying to calm the borrowers by letting everyone know that it is working hard on the legal challenges and will do everything it can to grant relief. No loan can be forgiven, though, until the block remains.

Biden Administration Response

The White House reacted to this long block by showing some disappointment but certainly not desperation. We believe we have legal authority to execute this program and believe the courts will ultimately agree.