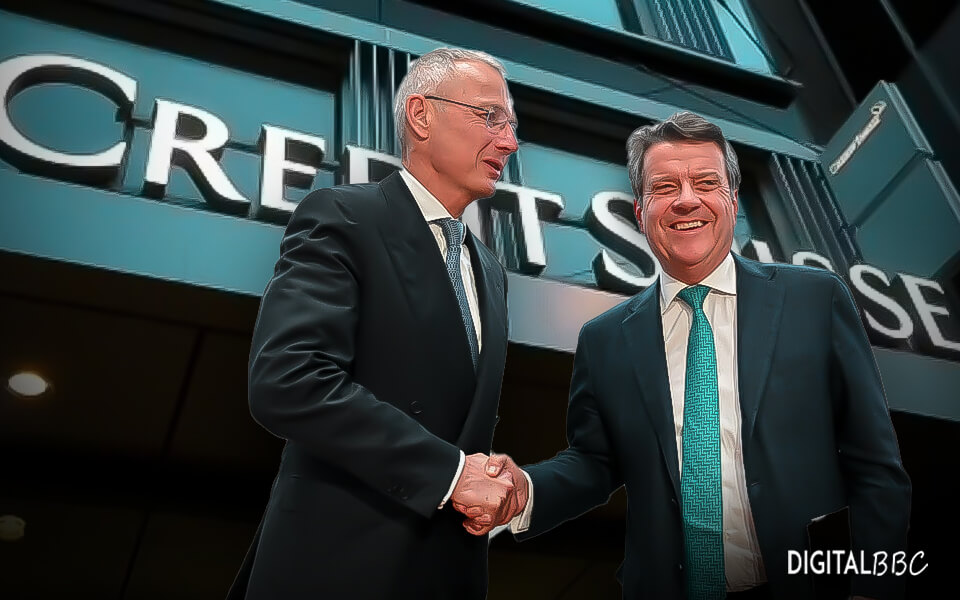

On Tuesday, the UBS group was in negotiations with Swiss authorities about loss protections related to the takeover of Credit Suisse Group AG and its regulatory capital requirements. There are still some kinks in the tie-up of the banks, and that issue was put together by the Swiss government over a weekend in mid-March, which prevented the catastrophe.

The assistance for liquidity offered by the Swiss government was up to 100 billion Swiss francs. Because of the deal, which led to potential losses, the Swiss government even agreed to shoulder up to 9 billion Swiss francs. On Tuesday, UBS said in a U.S. regulatory filing that the negotiation about the loss protection agreement is still ongoing.

UBS expected and stated in its latest filing that the main terms of the loss protection agreement should be settled before closing the purchase of Credit Suisse.

There was talk between FINMA and the Bank about “certain prudential capital requirements, risk weighted assets measures, and other capital and liquidity requirements for the combined firm”, but it did not expect to get finalized before the deal closed.

The acquisition of Credit Suisse is expected to be completed by early June, according to UBS. Credit Suisse almost came to the brink of collapse with a string of financial scandals and poor management.