Analyze the current state of the eurozone economy in terms of recent trends of expansion, inflation management, and monetary policy adjustments by the European Central Bank as of December 19, 2024.

The eurozone economy is currently at a challenging state with minimal inflation, slowing growth, and significant monetary policy shifts by the European Central Bank.

Economic Growth and Inflation Trends

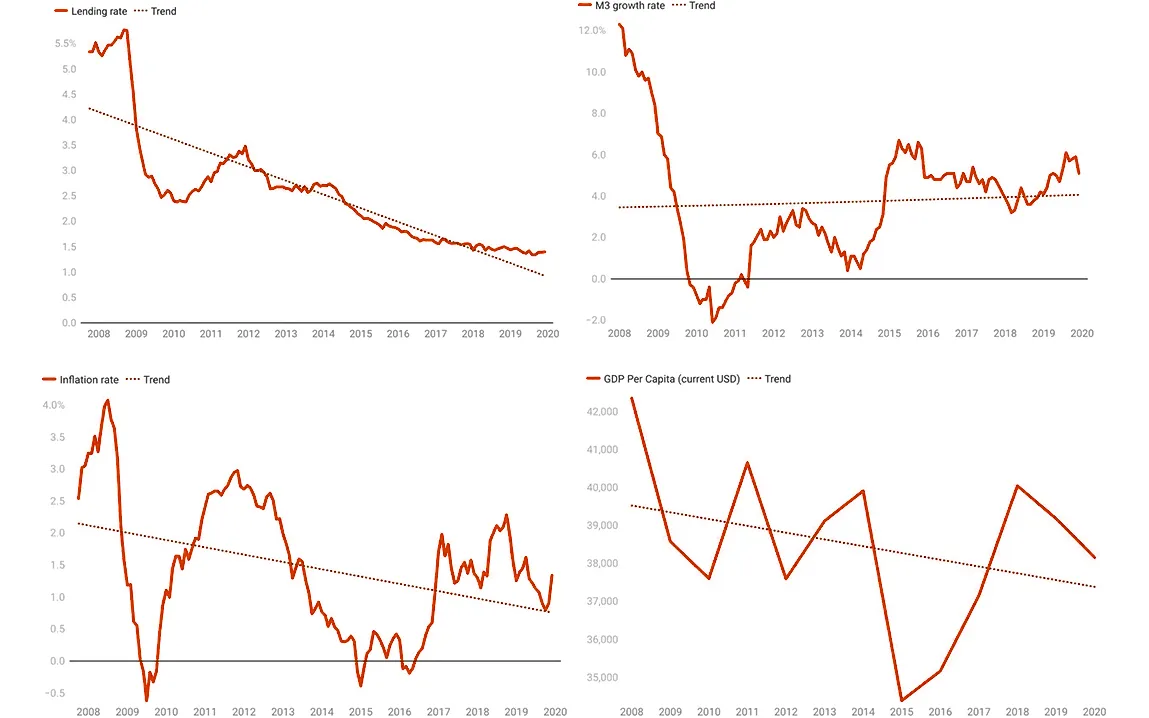

The eurozone economy is slowing down, recent data indicate. Instead of predicting 1.3% growth in 2025, the ECB lowered its growth prediction and now projects 1.1% growth. The nation’s political unpredictability and potential trade disputes with the US would contribute to this slowdown.

Late in 2022, inflation peaked at 10.6%, while in November 2024, it dropped to 2.3%. It is now starting to level off. This means that in the next couple of years, the rate of inflation will be moving in a circle around the target of the ECB. This would indicate that the worst is behind and that the inflationary peak may be ending.

Monetary Policy Shifts

Beginning in 2024, the ECB implemented a series of interest rate reductions in response to these economic indicators, bringing the benchmark interest rate down to 3%. Given the slowing predicted growth rate, this is the fourth cut since June to stimulate economic activity. Even ECB President Christine Lagarde has alluded to potential reductions in 2025, contingent on the state of the economy and inflation.

Fiscal Policies

The European Commission has proposed to eurozone nations modest fiscal contraction in 2025 and 2026, which would ensure debt sustainability. This is after spending a lot of money in the government on the energy crisis and the COVID-19 pandemic, which pointed out the need for fiscal austerity to achieve economic stability.

Market Reactions and Future Outlook

The financial markets have reacted to these changes with cautious optimism. Major brokers expect the ECB to further reduce rates in 2025, perhaps even into the negative range of 2% to 2.5%. Whether a country’s political unrest or the risk of the eurozone becoming entangled in trade conflicts will be enough to enable it to continue on its current economic path is uncertain.

Economic uncertainty is now bedeviling the eurozone, and the ECB monetary policy will play a pivotal role in resolving the issues regarding inflation and growth concerns. Monetary easing and fiscal restriction will significantly impact the prospects of the region’s economies for years ahead.