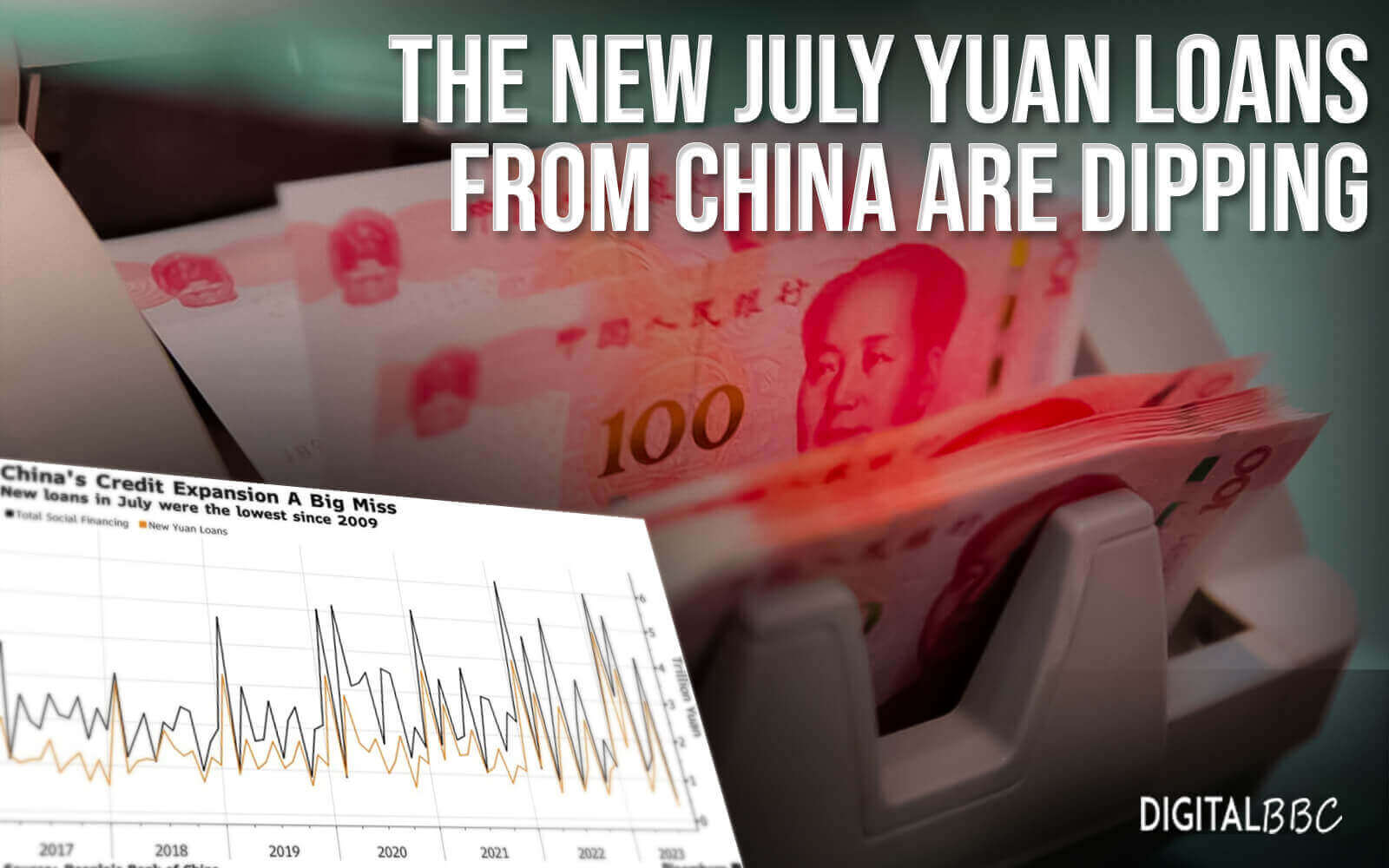

After record-leading In the first half of the year, China’s new yuan loans are projected to drop significantly from June to July. Despite the Sputtering recovery, the central bank seeks to support the economy so that it may surpass the level of the prior year.

According to the median estimate in the survey of 29 economists, in July, it was estimated that Chinese banks only issued 800 billion yuan in new yuan loans. A significant drop from 3.05 trillion yuan in June.

However, compared to the 679 billion yuan issued in the same month a year earlier, the expected new loans would be higher. According to data from the central bank, Chinese banks disbursed new loans totaling 15.73 trillion yuan in the first half of this year, which is the highest first-half total ever.

The growth of the economy was at a frail pace in the second quarter as demand at home and abroad weakened. With the fast-fading momentum after COVID, pressure is mounting on authorities to provide further stimulus to support activity.

The world’s second-largest economy is trying its best to restore the demand and pressure built on Beijing to unleash more direct policy stimuli. The consumer sector in China entered a state of deflation, and factory gate prices continued to decrease in July.

To Focus more on boosting demand and signaling more stimulus, the top leaders of China pledged to step up policy support for the economy following the tortuous post-COVID recovery.

Despite the pressure from government agencies to implement additional supportive measures, last week a top official from the central bank stated that the bank will employ a flexible policy instrument that includes Reserve Requirement Ratio Decares to guarantee relatively enough liquidity.

It was expected that the outstanding yuan loans would increase by the same 11.3% from a year earlier in July. The overall increase in the M2 money supply was 11.0% in July, down from 11.3% in June.

2.3 trillion was issued by the local government in the first half of the year, as shown in the data from the finance ministry. Authorities hastened the issue of special bonds for infrastructure to support the economy.

Any increase in the issue of government bonds might support total social finance, a comprehensive indicator of credit and liquidity. Outstanding TSF increased by 9.0% at the end of June compared to the same time last year, up from the end of May’s pace of 9.5%.

It is expected that TSF will fall sharply to 1.10 trillion yuan in July from 4.22 trillion yuan in June.