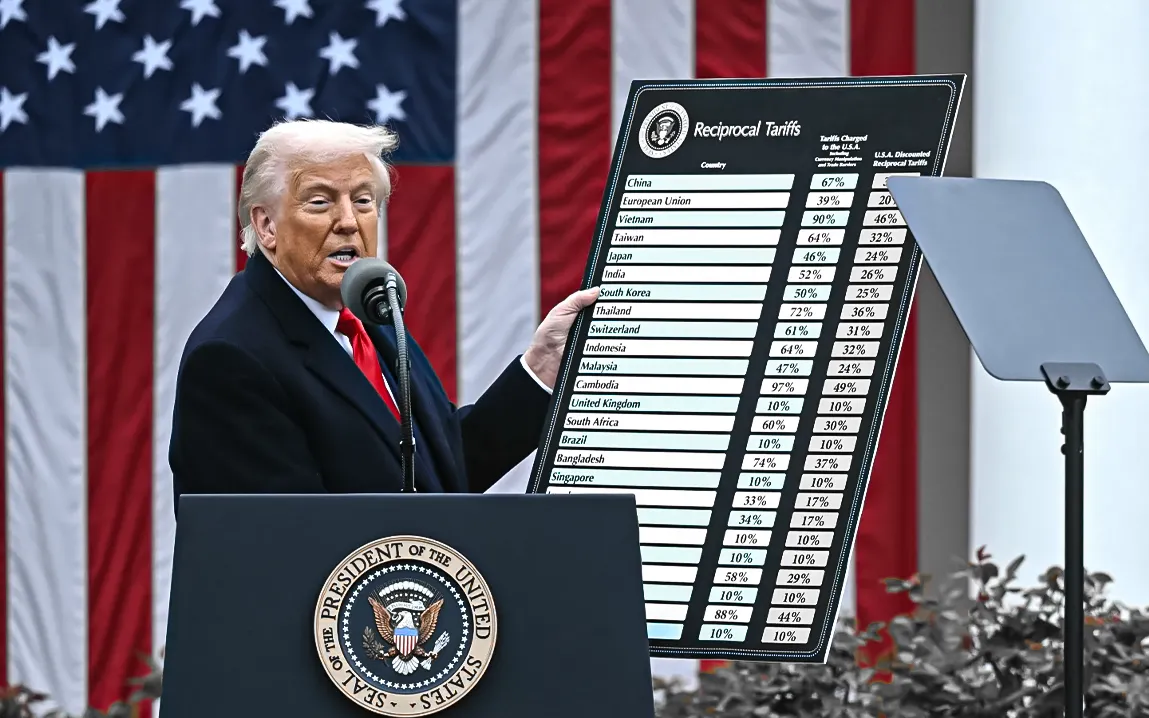

In a dramatic move that is sending shockwaves across international financial markets, President Donald Trump is unapologetic about his move to impose blanket tariffs on imports from many nations. Even as markets plummeted precipitously and global recession fears were on the rise, Trump is adamant that such tariffs are the required “medicine” to correct chronic trade imbalances.

Speaking on board Air Force One, Trump responded to fears over the market’s adverse reaction, saying, “I don’t want anything to go down, but sometimes, you have to take medicine to fix something.” This metaphor highlights his conviction that short-term economic pain is necessary for long-term prosperity.

Market Reaction

The financial markets have reacted swiftly to Trump’s decision. U.S. stock futures fell significantly, with the Dow Jones Industrial Average dropping by 2.1%, the S&P 500 falling 2.5%, and the Nasdaq plunging 3.1%. Bitcoin also saw a decline of about 6%. In Asia, the Nikkei 225 index in Tokyo experienced a near 8% drop, while Chinese markets fell sharply, with the Shanghai Composite losing 6.2%.

International Response

The global community has responded with alarm and pleas for talks. More than 50 countries have apparently contacted the White House to open talks that would soften the blow of the tariffs. Trump pointed to the overtures, declaring, “I spoke to a lot of leaders, European, Asian, from all over the world. They’re dying to make a deal.”

In particular, like-minded allies, including Israel and Vietnam, are requesting exemptions or modifications. Israeli Prime Minister Benjamin Netanyahu has an upcoming meeting with Trump to talk about the just-imposed 17% tariff on Israeli exports. citeturn0news19 Likewise, the leadership in Vietnam has said it is willing to lower its tariffs to zero for preferential terms with America.

European leaders, too, have expressed their concerns. Italian Premier Giorgia Meloni, though differing from Trump’s policy, expressed her willingness to use all the instruments at her disposal—both negotiation and economic ones—to defend those sectors that might be sanctioned.

Domestic Political Landscape

In the United States, the tariff policy has drawn mixed responses across the political divide. While some Republicans are backing the President’s move to counter trade imbalances, others are worried about the possible adverse effect on the economy.

Rep. Don Bacon of Nebraska said he would introduce a House version of a bipartisan bill that would make presidents explain new tariffs to Congress. The lawmakers would then need to approve the tariffs within 60 days, or they would lapse. Bacon highlighted the importance of Congressional oversight, saying, “We gave some of that power to the executive branch. I think, in hindsight, that was a mistake.”

Wyoming Senator John Barrasso recognized the President’s jurisdiction but pointed to the general unease, remarking, “There is concern, and there’s concern across the country. People are watching the markets.”

Administration’s Defense

Senior members of the Trump administration have been working hard to defend the tariff policy. Treasury Secretary Scott Bessent played down concerns of a looming recession, claiming that the tariffs are a calculated step to right long-term trade imbalances. He said, “What we are looking at is building the long-term economic fundamentals for prosperity.” citeturn0news17

Commerce Secretary Howard Lutnick validated the inevitability of the tariffs, highlighting that they are necessary to reset global trade dynamics. He said, “The tariffs are coming. Of course they are.”

White House trade adviser Peter Navarro brushed aside concerns expressed by business leaders, such as Elon Musk, who called for a zero-tariff scenario between the U.S. and Europe. Navarro implied that Musk’s stance was motivated by private business interests, saying, “He’s just looking out for his interest like any businessperson would do.”

Economic Implications

Market analysts and economists are polarized over the possible consequences of the tariff imposition. While the administration believes that the moves will spur local production and right trade imbalances, critics signal potential inflationary impacts and loss of employment in industries that use imported inputs.

Former Treasury Secretary Lawrence Summers decried the policy as self-contradictory, noting that if the intention is to raise revenue and bring back jobs, the tariffs would have to be permanent, which could inflict long-term damage on the economy. He warned that the administration cannot have its cake and eat it too.

With the tariffs to be implemented, the world economy is at a crossroads. The next few weeks will be decisive in whether these protectionist policies will pave the way for renegotiation