Although ordinary investors were mainly missing from the market, U.S. stocks have increased recently.

The S&P 500 Index has increased by 8.6% since Silicon Valley Bank’s bankruptcy on March 10 started to devastate the American financial system. After reaching a year-to-date and nine-month high of 4,198.05. it dropped 0.1% on Friday.

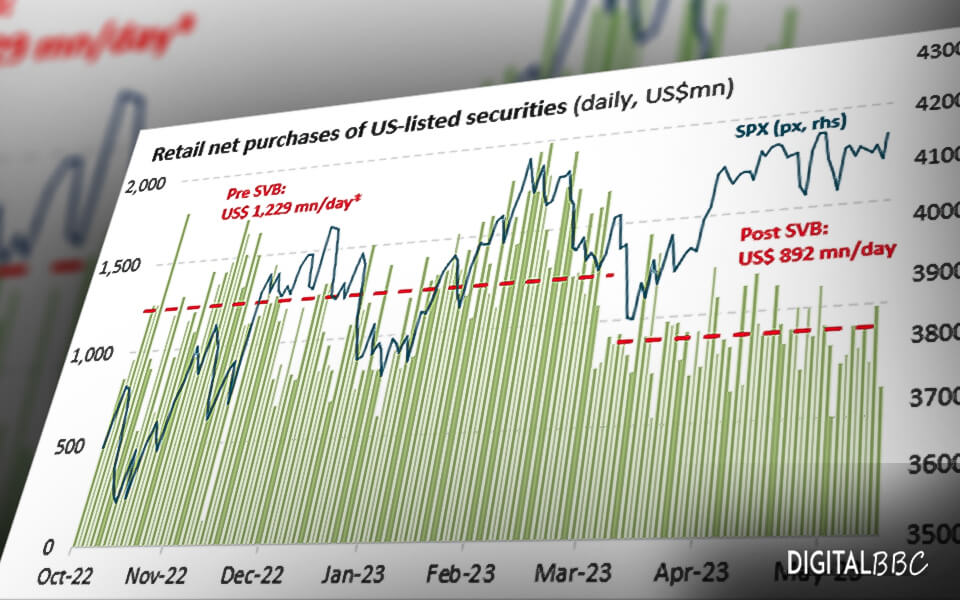

Despite less buying from regular investors, the rally of the past two months has continued. The average daily equity purchases from retail investors fell 27% over that period compared to the average over the previous two years, according to Vanda Research Ltd.

According to Vanda, a sizable portion of the overall decline in retail interest can be attributed to declining stock purchases in the financial sector. Even so, they continue to bring in more net inflows than any other industry saves information technology.

Ten stocks or ETFs have had daily trading activity rise by more than 20% over that time. Seven of them were from tech stocks, topped by Advanced Micro Devices. The others are JPMorgan Chase, Bank of America, and Charles Schwab.

Except for one day during the past two weeks ending Thursday, average daily net inflows into the U.S. stock market have stayed close to $900 million overall. But during that time, the S&P 500 rose 3.2%.