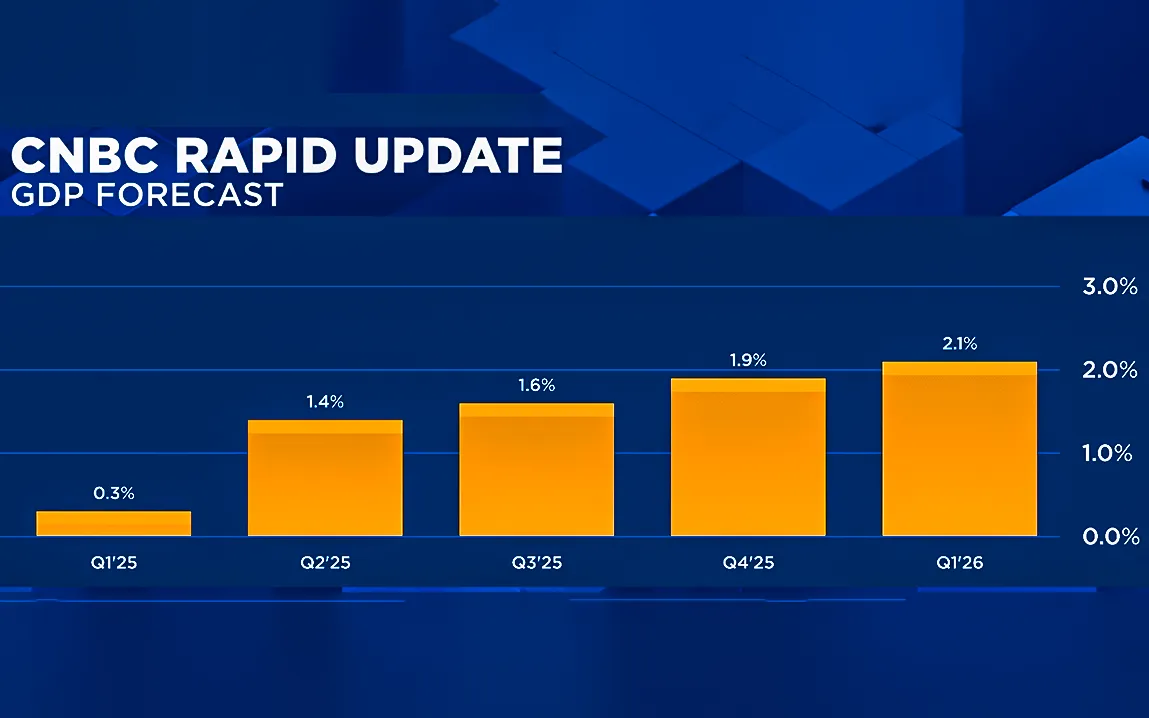

The United States economy is experiencing the symptoms of stagflation—slow growth and inflation—according to recent economic reports. A poll of 14 economists by CNBC forecast only 0.3% growth for the first quarter of 2025, a steep fall from the 2.3% growth seen in the previous quarter. This is the weakest performance since 2022, when the economy was recovering from the pandemic.

At the same time, the Core Personal Consumption Expenditures (PCE) measure, the Fed’s favorite inflation gauge, is likely to remain elevated at around 2.9% for most of the year before potentially easing in the fourth quarter.

The Trump administration’s imposition of new tariffs is a prime contributor to these economic hardships. They have raised consumer prices and lowered consumer and business confidence. Consumer spending in February rose only by 0.1%, up from a January decline of 0.6%, which registered consumer activity to slow.

Banks are becoming more concerned about the threat of a recession. Goldman Sachs, for instance, has increased the probability of a U.S. recession to 35% because of policy uncertainties and inflationary pressures from the tariffs. S&P Global and J.P. Morgan have also reduced their GDP growth estimates based on the trade policies and anticipated retaliatory measures from trading partners.

The stock market has also reflected these concerns, with the S&P 500 declining 5.7% in March, its worst month since December 2022. European and Asian markets have also taken a heavy hit as investors worry about a global trade war.

The Federal Reserve has a tough task in reacting to these economic conditions. The coexistence of sluggish growth and sticky inflation complicates the decision on interest rates and monetary policy. As the economy navigates through these uncertainties, stakeholders are keenly observing for developments and potential policy actions to mitigate the risks of stagflation.